How to raise $5M-$15M from Silicon Valley?

Learnings from a conversation with a VC from Sequoia Capital

Date: 16 Dec 2023

‘Hi. I would like to raise funds for my business. Something like $5-$15M from Silicon Valley. Is this possible?

I don’t have any idea how this works and would like to ask you some questions.’

This is what I said to a prominent venture capitalist from Sequoia Capital- one of the most successful funds in the world.

We were at his house sitting on the table, where I gathered the most crucial information for my fundraising strategy. I knew it was unlikely for this person to fund Team-GPT. So I went on to ask him a bunch of questions.

I was taking notes the whole meeting.

This article goes into all the questions I asked and the answers this VC gave me.

I’ve heavily based the fundraising process of Team-GPT (raised $4.5M) on this information.

Here are the questions + key findings.

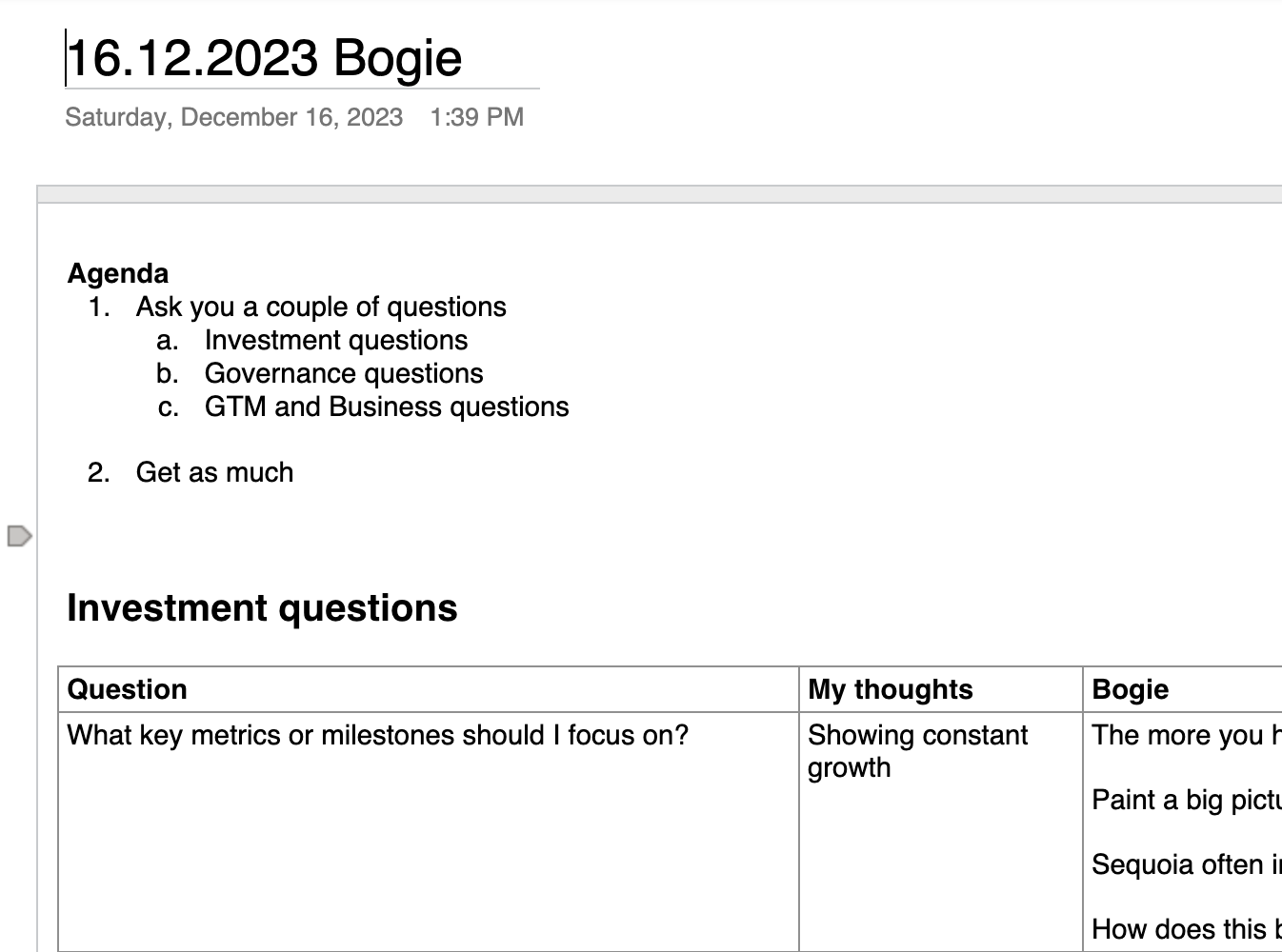

What key metrics or milestones should I focus on?

Show constant growth

Paint a big picture and tell a compelling story

Focus on how this becomes $500M ARR in 10 years

The more metrics you have, the better

How to target investors?

Talk to founders and get warm introductions to VCs

Start having informal meetings with investors way before you fundraise

Develop relationships now, as most investors are in for the next 10 years

Be prepared for “We are not investing yet but...” conversations

What are realistic amounts of capital to raise in a first round?

For first-time venture-backed entrepreneurs, $15M is likely too much

Start with Seed and target $0-$3M.

It’s supply and demand. If more people want your deal, you will likely get a better price

What kind of due diligence should I expect from investors?

You should know all the common ones by heart (ARR, #users, MAU, etc.)

Do cohort analysis

30d, 60d, 90d retention of different cohorts

Who leads the round - does it matter and why?

It matters significantly

Every lead investor in Seed optimizes around ownership

Whatever you raise will likely cost 20% of the company

Everybody hates co-leading (10% for one investor, 10% for another doesn’t make sense for anyone)

How to choose lead investor?

Main decision: “Do we like you, do we like the idea”

For Seed round, look for: Outlier founder (most important) with Unique and compelling insight in an Area where you can build a large business

Ask yourself: What investors do you want to have on the cap table?

Timeline for raising?

Be conservative, 1-6 months, brace for 3 months

Most time-consuming part is getting to the first term sheet. You just need one.

Thoughts on Business model?

Don’t set your price low

Aim for around $50/user/month

The moment you set your price, you set your target market

What are the key considerations for the Board of Directors?

It’s Seed round - YOU (the CEO) are the board.

OpenAI’s recent issue is just one of many examples of board-related problems but these will come later

Where should the company be incorporated?

Incorporate in Delaware. Full stop.

What are some examples of Sequoia’s recent investments?

Sequoia just invested $15M in a company that doesn’t have revenue

Why? The founder had several successful exists that made money to their investors

Examples of people who can raise $15M on an idea:

Ofir Ehrlich (LinkedIn profile: https://www.linkedin.com/in/ofirehrlich/)

Assaf Rappaport (LinkedIn profile: https://www.linkedin.com/in/assafrappaport/)

Additional note:

Wiz (company founded by Assaf Rappaport) raised significant funding from the get go

Sequoia is willing to invest large amounts ($15M) in pre-revenue companies

Founder track record is highly valued (multiple successful exits)

Successful founders can raise substantial amounts even without current revenue

How does Sequoia approach investments?

Sequoia makes about 20 investments, totaling $700M

10% of these investments drive the returns

They invest with very high conviction (translation: they need to be super-duper sure you are a winner!)

How should I frame my pitch? The VC advice on Team-GPT:

Don’t lead with “ChatGPT is difficult to adopt” as it won’t resonate with investors. ChatGPT is perceived as a good product

Focus on the transition from single player to multiplayer

Emphasize the shift from personal to company-wide story

What narrative should I build? The VC suggestion:

Enterprise communications have only been people-to-people

Going forward, it will be people-to-people and people-to-machine

There needs to be a new enterprise chat system that mixes both

What should I emphasize about myself?

Focus on why I am the person who will build this company -> you are the CEO and have to show you are ‘calling the shots’

Sequoia would invest in companies based on “Act 1” (the founder’s background and vision)

Key analogies for Team-GPT:

Slack is great for human-to-human communication

There needs to be a new enterprise chat system that incorporates both people-to-people and people-to-machine interactions

How should we structure the initial equity distribution?

In the beginning, founders are getting everything

What about early investors?

It’s better for me to have preferred stock than common stock -> later it turned out that founders always get common stock

How much should we allocate for the stock option pool?

Stock option pool should be 10-15-20% of the company

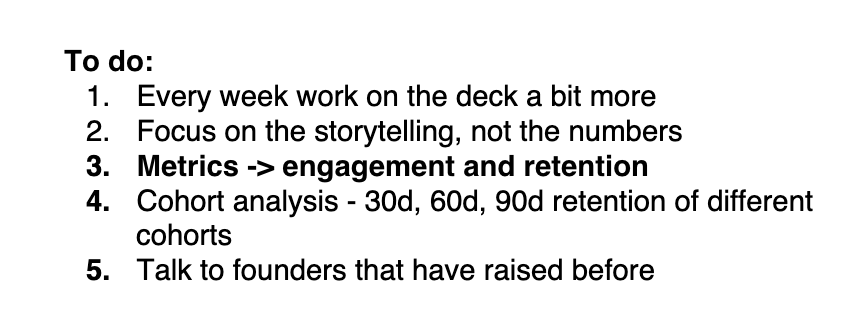

At the end I had written Next Steps

To do:

Every week work on the deck a bit more

Focus on the storytelling, not the numbers

Metrics -> engagement and retention

Cohort analysis - 30d, 60d, 90d retention of different cohorts

Talk to founders that have raised before

Talking to other founders

Indeed talking to founders was crucial.

I set a goal to meet 25 founders.

I met about 15.

These founders told me everything I needed to know about the fundraising process.

The Sequoia VC told me that books will be a waste of time.

I disagree then and now.

Read these 3 books before starting to fundraise:

They’ll help you think like a VC!

Thanks for reading and good luck fundraising!